-

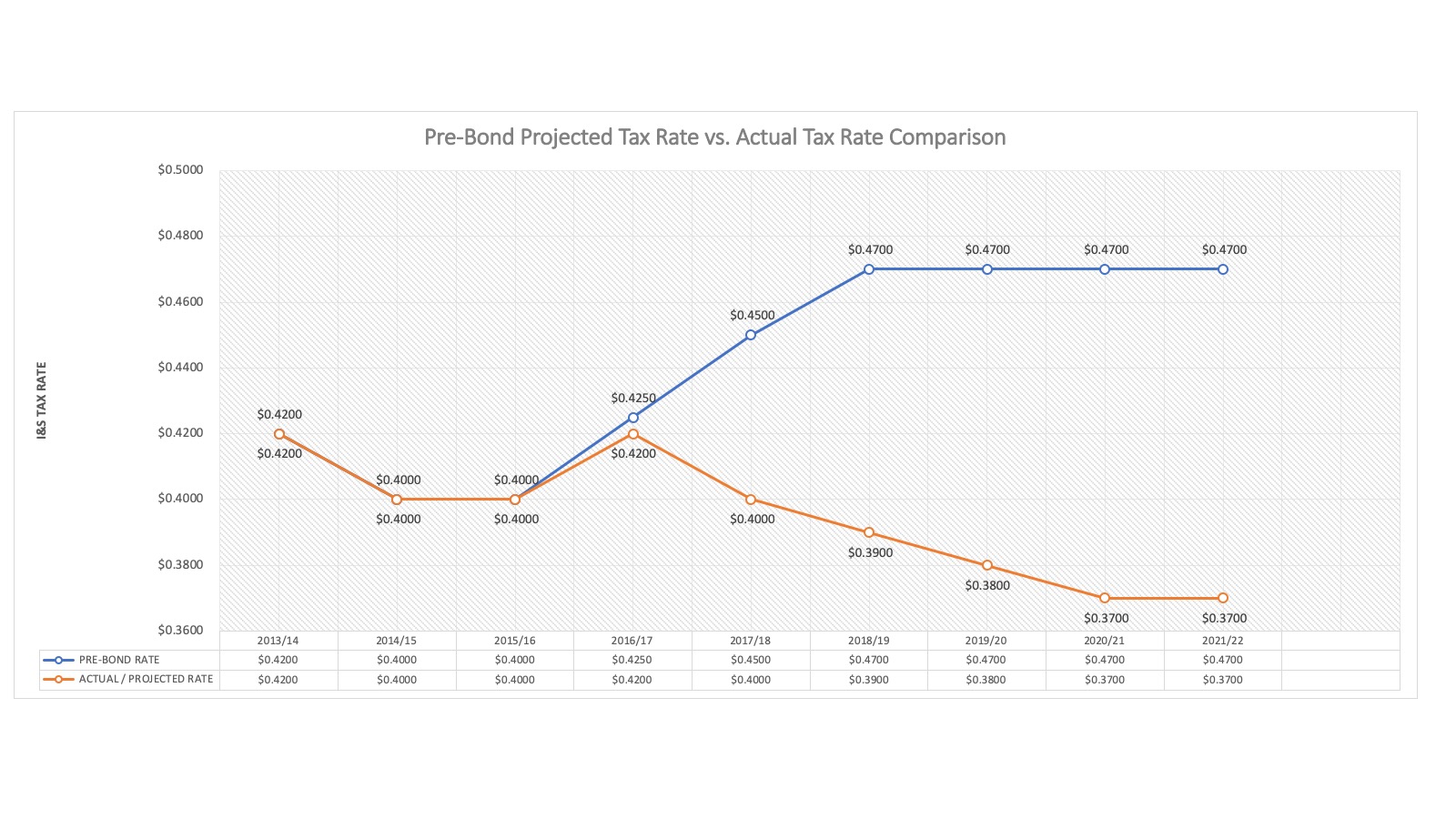

Tax impact of Rockwall ISD bond proposal.

-

An increase of 3/4th of a penny

-

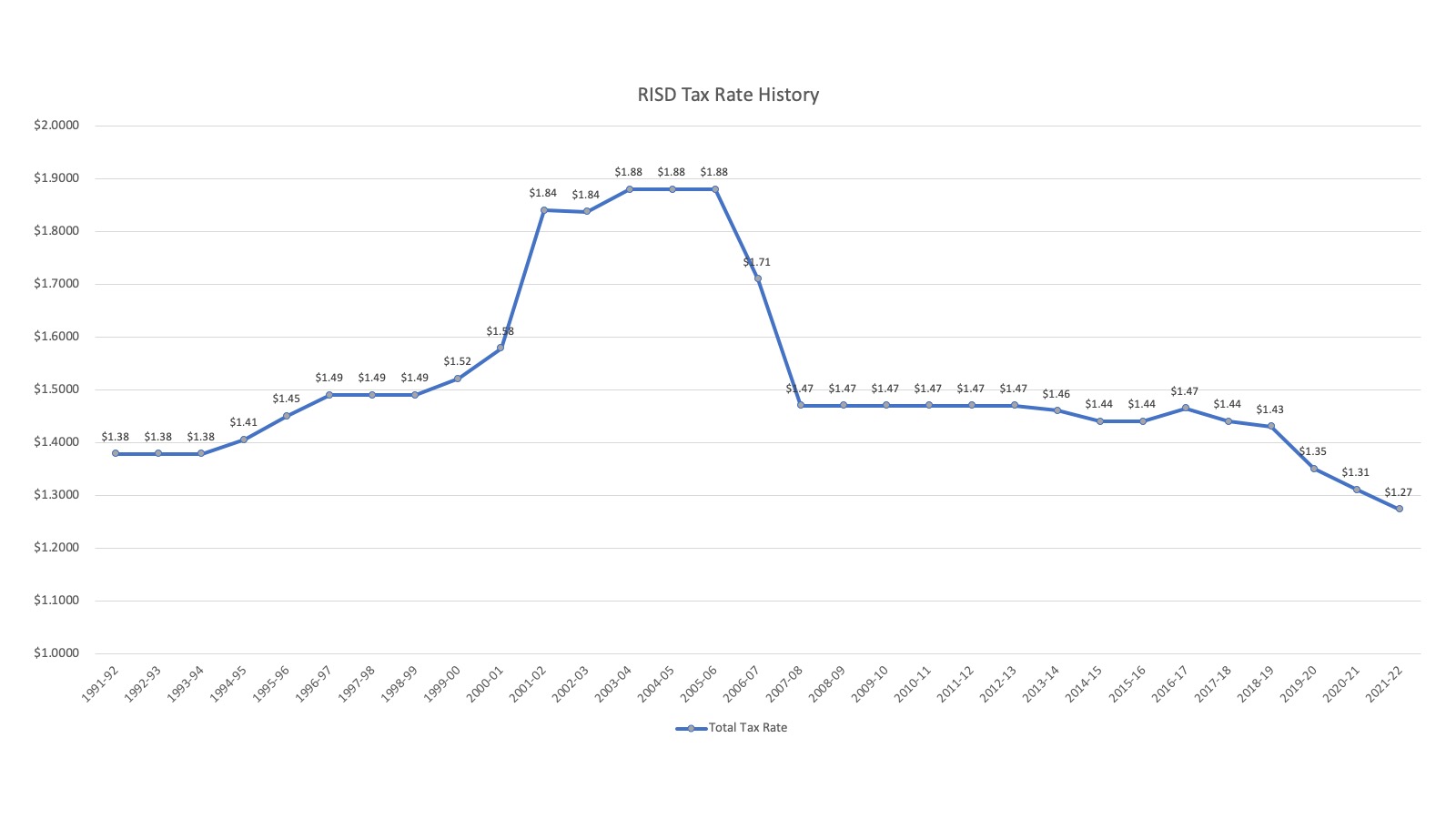

Property tax rate has decreased 17¢ since 2015

-

Past performance with your tax dollars:

-

- The tax rate will remain 17¢ less than in 2015.

- The current tax rate is the lowest in the past 30 years.

- The current tax rate is the lowest among nearby school districts.

- Earned the highest ranking from the state’s Financial Integrity Rating System for the past two decades.

- Achieved an ‘A’ district accountability rating from the Texas Education Agency.

- Capital projects from the 2015 bond package were collectively completed on time and under budget.

- Refinancing and refunding bonds from 2015 through 2019 saved taxpayers over $90 million – that’s more than enough to cover the cost of the state-of-the-art College & Career Academy.

-

The facts about the tax impact:

-

- If both propositions are approved, the tax rate will increase approximately 3/4th of a penny.

- Bonds will not be sold until the funds are required for a capital project.

- Short term projects will be financed only through short term bonds.

- Homeowners 65 years of age and older will see no increase in their property tax rate now or in the future if they have filed for their senior citizen homestead exemption.

How Public School Finance Works

-

A school district’s total tax rate is primarily funded by local property taxes and made up of two parts: Maintenance and Operations (M&O) rate and Interest and Sinking (I&S) rate. Each has a designated purpose and budget.

M&O tax rate vs I&S tax rate?

The M&O budget is used for the daily operations of the district: utilities, salaries, supplies, food and gas, etc.

The I&S budget is used to repay debt for capital improvements through voter approved bonds: new construction, renovations, additions, HVAC and roofing replacements, electrical systems safety and security and technology, etc.

Bond elections only affect the I&S tax rate. Proceeds from a bond CANNOT be used as part of the M&O budget, or to increase salaries.

Under state law, as long as a homestead and over 65 exemption application have been filed with the local appraisal district, the dollar amount of school taxes imposed on the residence homestead of a person 65 years of age or older cannot be increased above the amount paid in the first year after the person turned 65 – regardless of changes in tax rate or property value – unless significant improvements are made to the home, increasing the overall value.

Texas School Finance: Do Higher Property Values Mean More $ for the School District?

While Rockwall ISD’s tax rate is the lowest in 31 years, home values have risen. So does this mean Rockwall ISD receives more total revenue as a result? No. The Texas school finance system creates and inverse relationship between property value increases and state revenue. So, the Rockwall ISD Maintenance & Operations budget does not benefit from increased tax value growth, but rather the state benefits by lowering its contribution to the District. The system creates a situation where taxpayers pay more in local property taxes while the state pays less.